“Practical RMP® with Oracle® Primavera Risk Analysis”, a unique course, which covers both the theory and practical aspects of risk management, has been introduced to the Middle East with customers from UAE and Saudi Arabia.

“Practical RMP" is a specially designed course, which caters to the need of Risk Management Professionals - to get the (RMP®) certification from PMI®, and apply their understandings using a hands-on tool - Primavera Risk Analysis. In this post, some important features of this course have been outlined.

Risk Management is a crucial aspect of Project, Program and Portfolio Management. A well-managed project (or program or portfolio) means that risks are continuously identified, assessed, owners assigned, strategized for responses, actions taken by risk action owners and continuously monitored and tracked.

But, how this course helps the Risk Management Professionals? There are many features in this course. Here I have outlined only ten features. For comparison, followings are taken:

- Theory: Practice Standard for Risk Management® and the PMBOK® Guide from PMI

- Hands-on Practical: Oracle Primavera Risk Analysis Software (PRA)

Feature # 1: Risk Management Plan – Theory Vs Practical

The Risk management plan is prepared in the planning process. It has contents such as Project description, risk management methodology being used, roles, responsibilities of the manager, probability and impact definitions, probability and impact matrix etc.

In this course, you will be preparing a risk management plan on own your own (in .DOCX/PDF format) with the help of Primavera Risk Analysis tool.

Feature # 2: Risk Register – Theory Vs Practical

Risk Register is also prepared in the planning process, details of which are outlined in the Practice Standard for Risk Management and the PMBOK Guide.

This course tells you how they are done in a real time project. Sample of the risk register – both qualitative and quantitative - from a project is shown below. It is prepared with the PRA software.

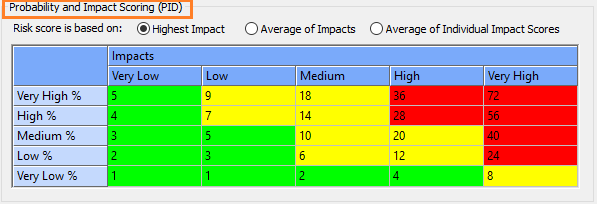

Feature # 3: Risk Probability and Risk Impact Matrix – Theory Vs Practical

Risk probability and impact are the two key characteristics of a risk, on which analysis of the risk is done. While the standard and guide, and the guide talks about the theoretical aspect, in this course, with the help of the software, the matrix is prepared.

A real impact matrix, taken from one of the course’s modules, looks as shown.

Feature # 4: Qualitative Risk Analysis Vs Quantitative Risk Analysis – Theory vs Practical

Both the aspect of risk analysis – qualitative and quantitative – are done in risk management.

To know a list of differences between qualitative and quantitative risk analysis, you can refer this link: Qualitative vs Quantitative Risk Analysis

The key aspects of Quantitative Risk Analysis are to analyse the overall project risk and find out the contingency reserve. Various probabilistic distributions such as Triangle, BetaPert, Uniform et al as theoretically noted in the standard and the guide can be applied. In the below screenshot from a live project, the quantitative risk register is shown.

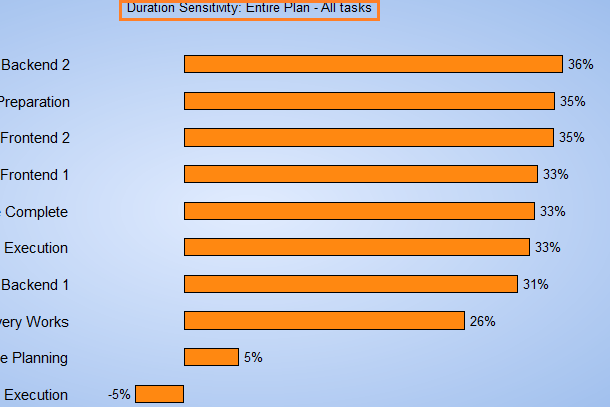

Feature # 5: Theoretical Risk Sensitivity Analysis Vs Real-time Risk Sensitivity Analysis

Risk sensitivity technique is applied in the quantitative risk analysis. One example of it is “Tornado Diagram”. With the help of the software tool, various sensitivity analysis can be done. A tornado diagram, taken from the project from this course is shown below.

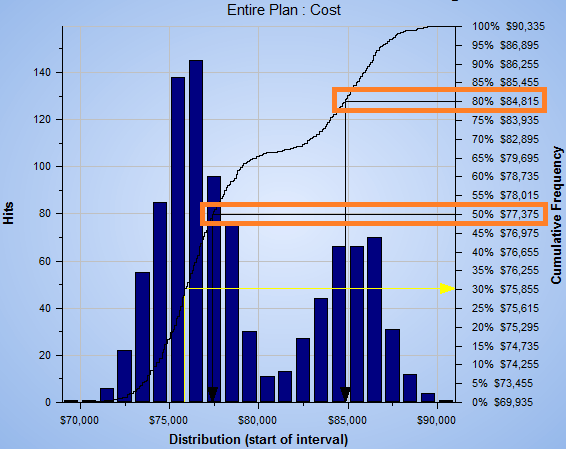

Feature # 6: Monte Carlo Analysis – Theory Vs Practical

In the below diagram, coming as result of Monte Carlo analysis, the chances of the project meeting the target is 50% with a budget of $75,855 whereas there is chance of 80% to meeting the budget, if it is increased to $83,815.

Feature # 7: S-Curve Analysis

Theoretically, S-curve analysis is mentioned in the risk management practice standard and the guide. Practically, below, the curve shown is via the distribution analyser of the PRA tool. S-curve is also available in Feature # 6 as just noted before.

Feature # 8: Risk Response Planning – Theory Vs Practical

There are various risk response strategies such as transfer, mitigate, exploit, accept – for both negative (threats) and negative (positive) risks. This has been compared and contracted with the risk mitigation strategies in the PRA tool. In Primavera Risk Analysis tool, there are certain differences in terms, but underlying concepts remain similar.

Feature # 9: Risk Manageability, Risk Proximity - Theory Vs Practical

Below one shown is the risk proximity. This is called risk urgency as the theoretical standards say. Risk with high proximity (or urgency) requires near time response. In the hands-on PRA tool, you can set the scale, a sample of which is shown below.

Similarly, it Risk Manageability, which informs whether the risk is manageable, can be practically considered with the PRA tool.

Feature # 10: Work Performance Reports – Theory vs Practical

There are various reports which are available – risk matrix report, risk score report, butterfly matrix report, criticality distribution reports etc.

Below is the butterfly matrix report, from a live project, as done with the help of PRA Tool.

Of course, in addition, there are a number of other topics which are covered, such as Risk Breakdown Structure (RBS), Contingency Reserve, Management Reserve, Risk Theme, Risk Attitude, Risk Tolerance, Risk Re-assessment, Risk Impact Plan etc.

At the end of the course, you would not only learn the theories from the standard and the guide, but also the practical aspects of it with multiple hands-on practical sessions. Of course, you will also have all the reference practical files in .PLAN and .RRX format, a few in .XER format.

Details on "Practical RMP" course is available at:

Your may also like:

Book Available for PMI-RMP Exam

No comments:

Post a Comment

Sign- or Log-in and put your name while asking queries in comments. Any comment is welcome - comments, review or criticism. But off-topic, abusive, defamatory comments will be moderated or may be removed.